The ETF tracks the MVIS (MV Index Solutions) Global Clean-Tech Metals Index, a rules-based index offering exposure to companies involved in the production, refining, processing and recycling of these metals. The VanEck Green Metals ETF (GMET) provides comprehensive global exposure to the producers, refiners, processors and recyclers of the metals that are essential to the world’s ongoing transition to a low carbon economy. large- and mid-cap stocks that have lower volatility characteristics, reduced carbon exposure and improved environmental, social and governance quality characteristics relative to the parent index.īoth iShares ESG ETFs have net expense ratios of 0.18%. The iShares ESG MSCI USA Min Vol Factor ETF (ESMV), based on the MSCI USA Minimum Volatility Extended ESG Reduced Carbon Target Index, favors U.S. The iShares ESG Advanced Investment Grade Corporate Bond ETF (ELQD) invests in investment-grade corporate bonds from issuers with favorable environmental, social and governance (ESG) ratings. It applies extensive climate-based screens to exclude issuers involved in fossil fuels and controversial activities, including civilian firearms and controversial weapons, tobacco and alcohol, based on the iBoxx MSCI ESG Advanced USD Liquid Investment Grade Index.

It will donate its net management fee to UNCDF to build climate resilience and adaptation in the least developed countries. The ETF tracks the MSCI ACWI Climate Pathway Select Index, which excludes certain securities based on certain ESG and climate change-related criteria and has an expense ratio of 0.30%. NTZO aims to maximize exposure to companies that can potentially benefit from opportunities arising from the transition to a lower-carbon economy and increase exposure to companies that are setting science-based emission reduction targets or commit to reduction targets and have a track record of decarbonizing at a rate of 7%. Impact Shares MSCI Global Climate Select ETF (NTZO) Climate Change and ESG ETFsĪmong the new ETFs focused on combating climate change are the Impact Shares MSCI Global Climate Select ETF (NTZO), developed in partnership with the the United Nations Capital Development Fund (UNCDF) and the Global Investors for Sustainable Development (GISD) Alliance the VanEck Green Metals ETF (GMET) and sustainable versions of iShares Investment Grade Corporate Bond and Minimum volatility equity ETFs.

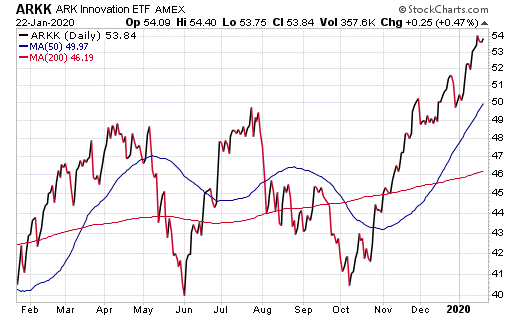

Matthew Tuttle, chief executive officer and chief investment officer of Tuttle Capital Management, the advisor to SARK, said in a statement that the fund is for investors who “believe that the current bull thesis for transformational industries is stretched,” or want protection their existing portfolio of high-growth stocks.

0 kommentar(er)

0 kommentar(er)